Navigating the Patient Recruitment Landscape: A Framework for Sites, Sponsors, and CROs

We were fortunate to attend the Society for Clinical Research Sites (SCRS) Global Site Solutions Summit this October 2025. Similar to other clinical operations conferences we have attended in the past few years, we were struck by two things: first, we continue to be impressed with the resiliency and positivity of the clinical research workforce despite challenging market conditions; and second,2) wow, there are a lot of patient recruitment companies out there!

Yes, clinical trial recruitment remains a persistent challenge: around 80% of trials fail to recruit enough patients, and many are delayed due to participant dropouts1. And, yes, the problem is recognized industry-wide so not surprisingly, the past decade has also seen an explosion of recruitment vendors, from creative agencies to technology platforms, some of them now leveraging AI. While many think of recruitment as solely an operational problem to solve with supplemental activities, it is important to remember that interest in a clinical trial begins in the potential participant’s mind long before a consent form is filled.

The good news is that Sites, Sponsors, and CROs now have unprecedented choice, but the challenge is knowing which partners actually remove barriers for patients and sites, and which add new ones. The purpose of this paper is to provide a framework to describe the evolving landscape of patient recruitment companies and to help sites, sponsors, and CROs identify where and when to use different approaches, considering both the supplemental capabilities needed and the behavioral realities that lie underneath a patient’s motivation to participate in a trial.

A Framework for Patient Recruitment Solutions

The landscape for solutions to accelerate clinical trial recruitment is best understood as a spectrum, ranging from pure creative agency work to technology-driven solutions, with many hybrids in between. As seen in Figure 1, traditionally, recruitment solutions were based on creative work including single-study content pages, communication messages, IRB approval and translation. As technology became more prevalent, offerings quickly evolved to include on-line screeners for patient self-qualification and platforms to track the status of potential participants. Over the past year, AI advances have further expanded the availability of recruitment technology to increase the use of data-driven patient identification. At the same time, the availability of large language models have also enabled the introduction of a new access of competition at scale; namely, patient-centric multi-study search.

Figure 1: Patient Recruitment Company Landscape

External factors such as protocol requirements, population characteristics, and geographical targets, coupled with existing site, sponsor, and CRO capabilities, shape the approach selected for an individual study. It is also common for a single study to deploy more than one recruitment solution, and sometimes even more than one provider within the same segment.

1. Content Development and Outreach

As mentioned above, the earliest patient recruitment offerings were delivered by companies that design, launch, and manage advertising, education, and engagement strategies. These organizations often bring experience with regulatory-compliant messaging, creative development, and centralized tracking, often through phone or email to the site. Services may include message development, translation and ethics approval of messages, study websites, media planning (digital, print, radio), and pre-screening call centers.

At its core, content development is more than design and messaging. It is about how people process information under uncertainty. Neuroscience research shows that when faced with unfamiliar or complex material, people rely on cognitive shortcuts: they skim, they look for familiar cues, and they disengage quickly if overwhelmed. Framing and tone can change intent: small wording differences such as “help researchers understand” versus “test an experimental drug” can double or halve response rates. In general, the more challenging the protocol requirements and/or population characteristics, the greater the need for an expert creative campaign.

2. Outreach + Technology

Companies in this segment combine digital media expertise with patient engagement, screening, and referral technology. They typically run paid search and social campaigns, create landing pages, use online pre-qualification surveys, and analyze funnel analytics to track performance from outreach through referral (and sometimes through consent and enrollment).

Although digital outreach creates a moment of openness where attention can shift into action, patient curiosity does not equal commitment. Even small increases in friction, such as requesting patient information too early, using long screening forms, or having a disconnected handover to the site, can cause sharp drop-offs in referrals. In contrast, when information is provided upfront prior to asking for personal details, engagement is broken into small, achievable steps, and there is no disruption to candidate flow, so potential participants are more likely to proceed with referral and screening. For a campaign to be successful, it is not just about the targeting technology; it is about whether the system makes participation easier or harder for patients and sites. This is where automation should serve empathy, not replace it. Systems that provide study details in patient-friendly language, personalize follow-up timing, simplify next steps, and anticipate drop-off points can nudge action without eroding patient trust.

3. Screening & Workflow Technology

Software as a Service (SaaS) technology is the primary theme in this segment with a focus on pre-screening and referral tracking, often coupled with adjacent workflow tools, ranging from e-consent and reminders for patients, to document collection and site start-up training modules.

Workflow platforms promise efficiency, but success depends on how well they reduce rather than add to site workload. Coordinators already juggle several systems with upwards of 22 logins for a single study2, which multiplies quickly given most coordinators manage an entire portfolio of studies. Each additional login or duplicated field is not just a workflow inefficiency, it is a behavioral tax on focus and a drag on interest in participation. Neuroscience tells us that multitasking increases stress and reduces accuracy. Technology that integrates smoothly with existing site systems and processes can relieve pressure. A poorly designed system risks creating more bottlenecks for both staff and patients.

4. Patient Identification ± Screening Technology

In this landscape segment, companies leverage technology to pre-identify potentially eligible patients based on information from electronic health records, claims, genomics, or other datasets. This approach is most prevalent in the US, and may include tools that flag candidates in the medical record, match patients based on AI, and/or automate referral alerts. Identified candidates are then contacted, presented with study details, and asked to participate.

Importantly, being “identified” for a trial is not the same as choosing to join one. Algorithms surface candidates; relationships convert them. Autonomy and trust remain central. A flagged alert may get attention, but whether a person agrees to participate depends on the human interaction that follows, which can be highly variable in conviction, especially when delivered by someone who lacks familiarity with study benefits and messaging. Technology can open the door, but people walk through it when they feel respected, safe, and supported.

5. Multi-study Search + Technology ± Outreach

Similar to data-driven patient identification, large language models and AI have enabled a new category of platforms that allow patients to search across multiple studies and conditions. Some providers display only studies from paid customers, while others provide access to all studies listed on global trial registries. They also differ in how much information is shared with the user before requiring patient registration. Many companies in this segment also offer referral tracking and digital outreach as add-on services.

For patients, what matters is the confidence that they can explore safely before committing. Platforms that require patients to register before learning basic study details can erode trust and negatively impact conversion. When people understand what they are signing up for before being asked to share their information, they are more likely to continue. The most effective systems time registration to follow interest, not precede it.

Practical Considerations for Sites, Sponsors, and CROs

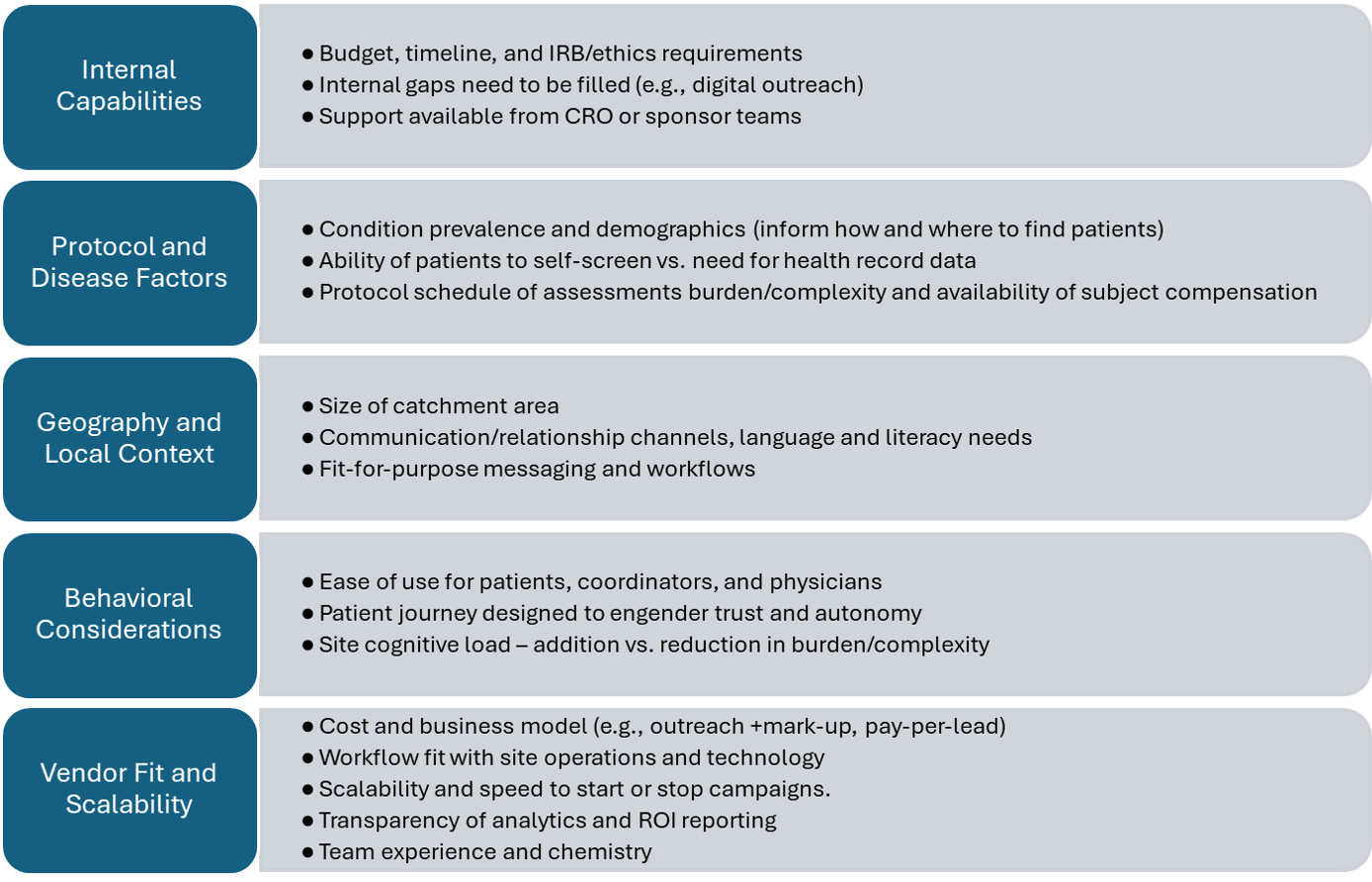

When evaluating options for recruitment support, it helps to think about your needs from several different perspectives. Figure 2 provides a sample approach to selecting the right partner for your study and organization.

As seen in Figure 2, factors that are important in decision making include, but are not limited to:

- Internal capabilities: focus on providers that fill functional gaps, considering both internal site capabilities and support being offered from sponsors and CROs.

- Protocol and disease factors: in general, the greater the disease prevalence and patient ability to self-qualify, the more likely direct-to-patient outreach is to be successful. The exceptions are conditions where a clinical trial is the only care option (e.g., rare disease). In this case, patients or their caregivers actively seek studies online and will travel vast distances to participate.

- Geography and local context: effective recruitment should adapt to local culture, language, and media habits.

- Behavioral considerations: the most successful approaches are those that make each interaction feel personal, timely, and relevant, even when automated.

- Vendor fit and scalability: use and adoption are highest when the solution fits the site’s needs, including cost model, workflow, timing, and team compatibility.

Figure 2: Factors Influencing Clinical Trial Recruitment Partner Selection

Conclusion

While the sheer number of recruitment companies can feel overwhelming, this framework offers a way to segment the offerings, narrow down the field, and evaluate providers objectively. But, the information highlighted above can only go so far. Regardless of whether the work is delivered internally, or whether an external partner is selected, enrollment success ultimately depends on execution in a manner consistent with basic human behavior: meet people where they are with clear communication, timely responsiveness, and respect. True innovation will come from integration, combining behavioral insight with the right technology and process to build trust at every step.

About the Authors

Elisa Cascade

Elisa is a seasoned clinical research executive with decades of experience leading site, sponsor, and CRO engagement globally. She is currently the Chief Growth Officer and Head of Americas at TrialScreen. Previously, she has held Executive leadership roles across clinical trial operations and digital health, and is recognized for her expertise in patient recruitment strategy, technology adoption, and site support. Elisa brings a deep, practical understanding of how industry stakeholders evaluate and implement recruitment solutions.

Dr Emma Burrows

Emma is a neuroscientist and academic turned scientific engagement leader and currently leads Scientific Engagement at TrialScreen. With a PhD in Neuroscience and over 15 years’ experience spanning research, policy, and science communication, she focuses on the human side of clinical trial participation: attention, motivation, trust, and behaviour. Emma brings a fresh interdisciplinary lens that connects behavioural science to the realities of recruitment, helping to translate complex systems into clear, patient- and site-focused insights.